Table of Contents Show

To measure the temperature of anything is to know if it’s hot or cold, and Bitcoin Price Temperature is not different. The Bitcoin Price Temperature (BPT) is a way to measure how hot or cold the current Bitcoin price is trending at any one time.

The BPT metric makes it easier for traders and investors to anticipate what might happen next in the market. It’s basically like a thermometer that goes up when the price movement gets hotter and down if cooler changes occur.

The BPT uses Moving Averages (MA) as its basis and then combines these with other technical indicators to give us an overall picture of the situation.

The Moving Average is the average closing price for BPT over a chosen time frame, divided into several periods of equal duration. For instance, a 14-day simple moving average for BPT is calculated by adding its closing prices over the previous 14 days and dividing that total by 14.

The MAs help defines whether the market is a bull or bear market and provide insight into future trends so traders can plan accordingly. For example, if the MA line shows that prices are on an uptrend, this could indicate that buyers are in control and the market is likely to grow.

Additionally, the BPT uses a range of other indicators such as Fibonacci retracements, relative strength index (RSI) and average true ranges (ATR).

These are combined to provide traders with an accurate assessment of the situation. The overall result is that traders gain insight into what’s happening in the Bitcoin markets to make better investment decisions. Let’s break that down further.

What is a Bear Market?

A bear market is a period in which the price of an asset decreases significantly. Bear markets typically occur when there’s widespread fear and uncertainty in the market, and they can last for months or even years.

What is Bull Market?

A bull market is a time in which the price of an asset increases significantly. The term was initially used to describe a prolonged period of rising stock prices, but you can also apply it to other assets such as cryptocurrencies.

Bull markets typically occur when there’s widespread optimism and increased investor confidence in the asset; therefore, the market is bullish.

What is Fibonacci retracements?

Fibonacci retracements are a sequence of numbers that help traders identify support and resistance levels on price charts. These numbers come from the Fibonacci sequence (FR or FS), a series of numbers where each figure is the sum of the previous two.

In terms of trading, these levels can be used to determine potential entry and exit points to maximise profits.

What is the Relative Strength Index (RSI)?

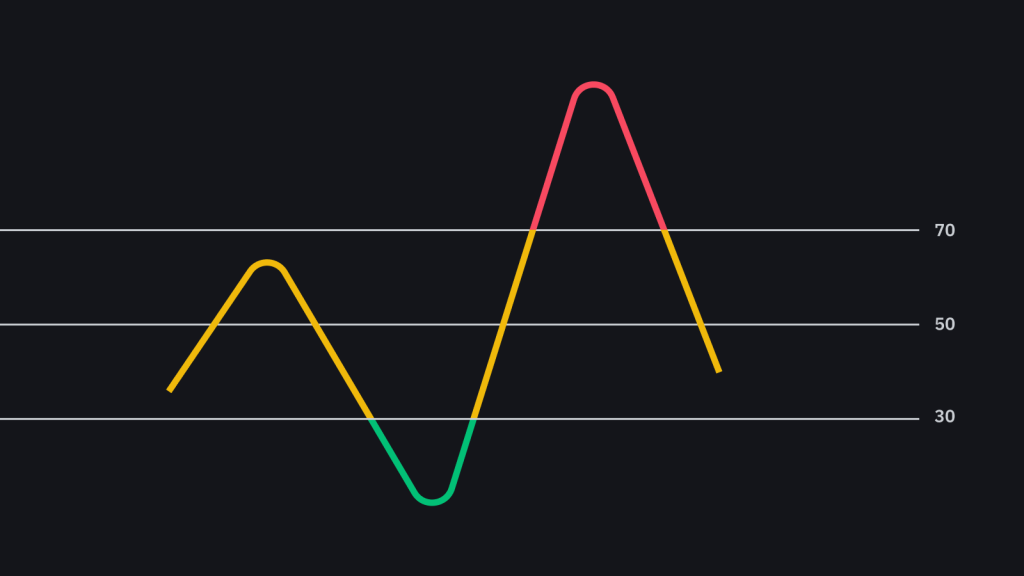

The RSI indicator helps traders measure momentum by comparing gains and losses over different periods. Specifically, it compares the average gains with average losses over a given period to understand how strong or weak an asset’s performance has been in comparison.

If an asset’s RSI rises above 70, it typically indicates that it is overbought and due for a correction.

What is the Average True Range (ATR)?

The ATR measures an asset’s price volatility. If there’s a giant swing in prices, the ATR will register this as a high value; if the market has been stable and prices have not moved much, then the ATR will show this too with low values.

This metric helps traders understand how volatile an asset can be and whether they should consider buying or selling it.

Bitcoin Price Temperature is an invaluable tool to help traders stay one step ahead of the markets. It combines multiple indicators to give us an overall picture of what’s happening so traders can make more informed decisions. With a bit of practice, anyone can learn how to use BPT to their advantage in the markets.

In short, Bitcoin Price Temperature is an effective way for traders and investors to understand better what’s happening in the cryptocurrency markets. With this knowledge, they can plan their investments accordingly and take advantage of potential gains or losses.

What’s the outlook for Bitcoin in 2023?

With BPT, you can stay ahead of the markets and make informed investment decisions. After all, knowledge is power in the world of crypto trading!

Techdaring wrote this article based on research from bgeometrics.com and tradingview.com. It should not be considered financial advice or an endorsement of any particular product or service.

Information provided here is for information only and is not a recommendation to invest in Bitcoin, cryptocurrency or related products. Please do your own research before purchasing anything associated with this topic.

No matter where you stand in cryptocurrency, Bitcoin Price Temperature has something to offer everyone who wants to learn more about the market and plan their investments accordingly.

So if you’re looking to invest in Bitcoin, then be sure to keep a close eye on the Bitcoin Price Temperature. It might give you the edge you need to make a successful move.