Table of Contents Show

Phone banking is almost the only way to bank these days, with 8 of the best apps like Cash App, making it easier for individuals to send and receive money instantly. These apps have revolutionised how we manage our finances with various features, from payment-tracking merchant services to peer-to-peer payments.

We look at all the options available and consider whether Cash App is the best mobile phone money app or if the others offer an overall better service.

Venmo

Venmo is one of the most popular Cash App alternatives due to its easy user interface and intuitive navigation. It’s particularly great for splitting bills or sending smaller amounts between friends â no need for awkward conversations about repayment! Plus, you can track your payments always to know where your money is going.

Set up in 2009 is actually a subsidiary of Paypal and allows you to pay for goods and services directly from your bank account. It’s also a great option for people who are looking for an alternative payment method when shopping online.

Apple Pay made easy

Apple Pay is Apple’s own mobile payment system which integrates with its devices, such as iPhones and iPads. You can use it to send money, make payments or even get access to loyalty cards. It’s a great way for Apple users to pay securely, quickly and conveniently.

Apple Pay was introduced as a feature in the Apple family in 2014 and is widely used among iPhone users and android alike.

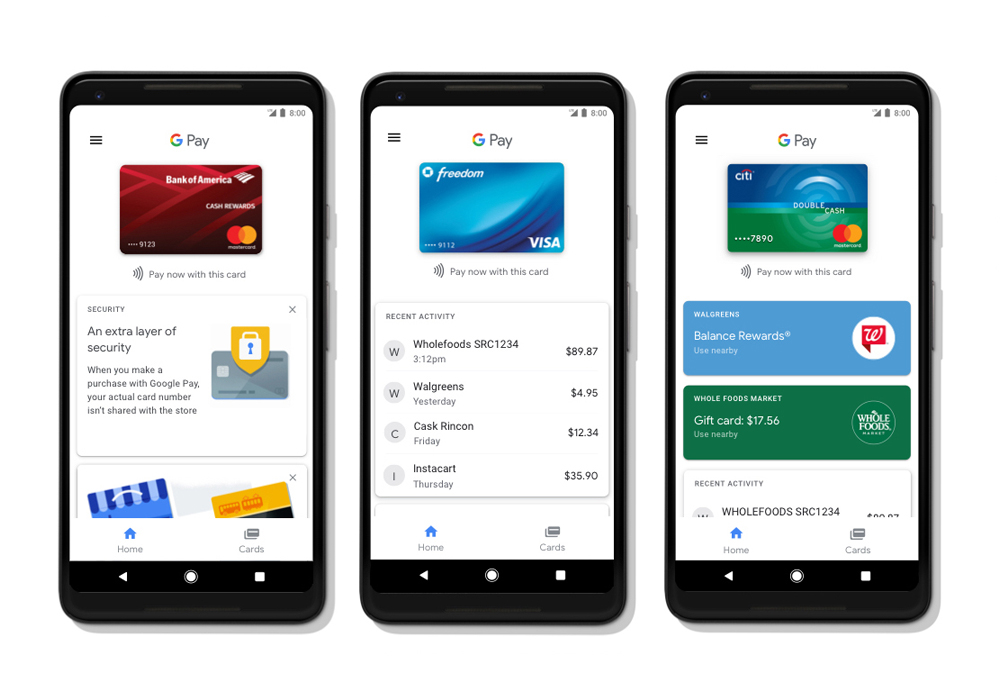

Google, Google Pay

Google Pay is Google’s own payment system, allowing Android users to send money directly from their bank accounts. It’s incredibly secure and offers fast transactions with its near-field communication technology. Plus, it has an easy-to-use interface, so it’s great for those new to the world of mobile payments.

Google Pay is also great when you’re travelling abroad as its transaction fees are low, and there are no currency exchange fees. It’s one of the most reliable payment systems out there.

Paypal pays up

PayPal has been around since 1998, making it one of the oldest online payment services available. It allows users to pay or transfer money directly from their bank accounts or via a credit or debit card. Plus, with its simple user interface, you can easily track all your payments and transactions in real-time.

PayPal is best for larger transactions between businesses and merchants â perfect for entrepreneurs who need to secure all their payments.

Zelle zips it up

This peer-to-peer payment system is owned by Early Warning Services and works with over 30 U.S. financial institutions, including Bank of America, Wells Fargo and JPMorgan Chase.

You can send money to people who have their account details stored in the app â simply enter the amount you want to send, and they’ll receive the funds instantly.

However, if your recipient isn’t registered with Zelle, they’ll need to do so before receiving any funds from you; this may not be suitable for those looking for an instant transfer service.

Remitly sends it back home’

Remitly is a great app for those wanting to send money abroad. It allows you to use multiple currencies and has great exchange rates, so you’ll get more bang for your buck when sending money overseas. Plus, it offers a range of payment options, from direct bank transfers to debit or credit card payments

It’s also incredibly secure with 256-bit encryption, so you can rest assured that your financial details are safe and sound.

Meta Messenger talks the talk

Meta Messenger is a great alternative to Cash App if you’re looking for an app that combines messaging and payments in one service. It enables users to transfer funds over chat by simply attaching their payment information to the conversation. The best part is its low transaction fees â just 0.2% â making it great for those looking to save money

Plus, with its built-in security features and encryption, your financial data is always safe and sound.

Western Union still rocks

Sending money abroad in the old days was a faff, but not anymore.Using Western Union is a great option for anyone looking to instantly transfer money abroad, with low fees and competitive exchange rates.

Plus, you can send it directly to your recipient’s bank account or even pick up the cash at one of their agent locations worldwide. And this app also offers additional features such as bill pay and check to cash, making it an all-in-one financial service

Conclusion

Cash App may be the most popular payment app on the market, but plenty of alternatives offer more flexibility or better value for money. Whether you’re looking for an international transfer service or a messaging app that lets you pay, these eight apps are great alternatives to Cash App.

So why not give them a try? You may find one that works even better than Cash App – if you do, let us know.